All Categories

Featured

Nonetheless, these plans can be much more intricate compared to various other kinds of life insurance policy, and they aren't always right for each financier. Talking to a seasoned life insurance policy representative or broker can aid you decide if indexed global life insurance policy is an excellent fit for you. Investopedia does not supply tax, investment, or monetary services and recommendations.

, adding a permanent life policy to their investment profile might make feeling.

Low rates of return: Current study found that over a nine-year duration, staff member 401(k)s grew by approximately 15.6% per year. Contrast that to a set rate of interest of 2%-3% on an irreversible life policy. These differences build up with time. Applied to $50,000 in financial savings, the fees above would equal $285 each year in a 401(k) vs.

In the very same blood vessel, you could see financial investment development of $7,950 a year at 15.6% rate of interest with a 401(k) contrasted to $1,500 each year at 3% interest, and you would certainly invest $855 even more on life insurance policy every month to have whole life insurance coverage. For lots of people, obtaining long-term life insurance policy as component of a retirement strategy is not a great concept.

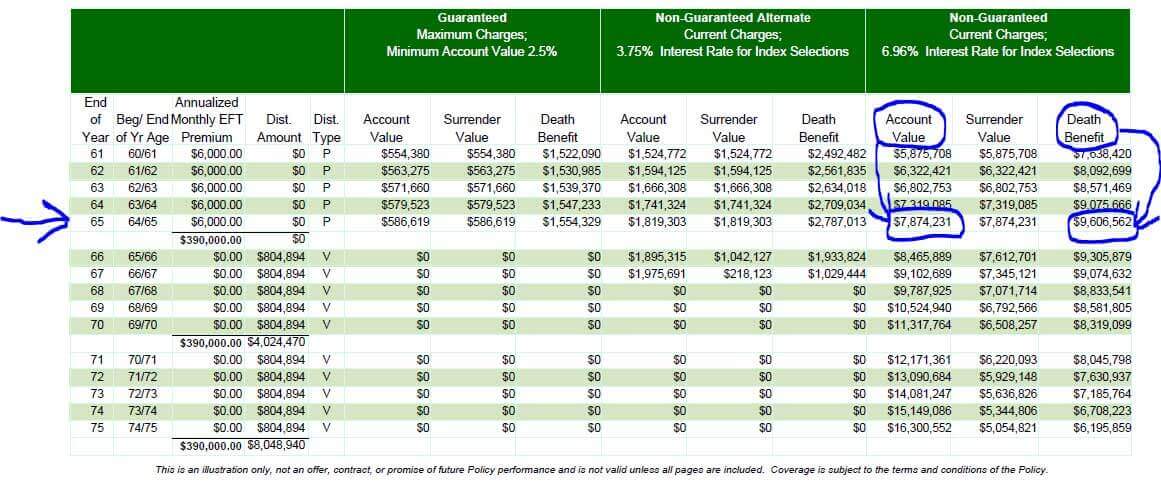

401(k) Vs. Indexed Universal Life Insurance: Which Is Better For Income?

Conventional financial investment accounts usually supply higher returns and even more adaptability than whole life insurance coverage, yet whole life can supply a reasonably low-risk supplement to these retirement savings methods, as long as you're confident you can pay for the premiums for the life time of the plan or in this situation, till retirement.

Latest Posts

Difference Between Universal And Whole Life

Single Premium Indexed Universal Life

Selling Universal Life Insurance